This is the story of Bob. An Australian living in Hong Kong.

I met Bob when he arrived in Hong Kong some 20 years ago, and he made two property purchases:

One in Sydney, in Crows Nest, a terrific lower north shore suburb. He purchased a 2-bedroom, 2-bathroom spacious (90 sq. m) apartment off -the- plan with a car park.

He also put a 10% deposit on an off-plan apartment in Brisbane.

To hedge his bets.

The Brisbane one completed in 2004 and he took possession for AU$303,000.

The Sydney one completed a year later, and as you would expect was quite a bit more expensive.

The Brisbane apartment was a smaller (75 sq. m) 2-bedroom, two bathroom, one car park in inner Brisbane.

He secured a 90% mortgage, meaning he only had to outlay his initial 10% $30,300) (plus legal costs and stamp duty).

The apartment has seldom been empty over all the time since Bob took possession back in 2004.

He was hoping to make windfall gains on the capital growth in a couple of years.

And when this didn’t happen, he thought he should sell. Back to Sydney

When Bob placed his off-plan deposit in 2003 it turned out that this was the top of the market at that time in Sydney.

After 2 years Bob sold it as it “wasn’t moving.” As you can see from the graph following he was right.

It wasn’t moving, and wouldn’t move again for several more years.

So after only 2 years of holding the Sydney one he had sold it, as it “wasn’t moving” and he couldn’t afford to hold it any longer.

But looked what happened after he had sold!

And a few years later he wanted to unload his Brisbane one too as he said that with all the expenses he was “bleeding money every month” as the rent did not “even get close” to covering the mortgage and all the expenses.

Now, without even looking at the figures, I knew that after so many years of ownership, and even though he borrowed 90% of the price, that seemed unlikely.

So I sat down and got all the calculations from him, the rent receipts, the bank statements, expenses and loan documents, and what I discovered was SHOCKING.

There are a few ways to look at real estate investments.

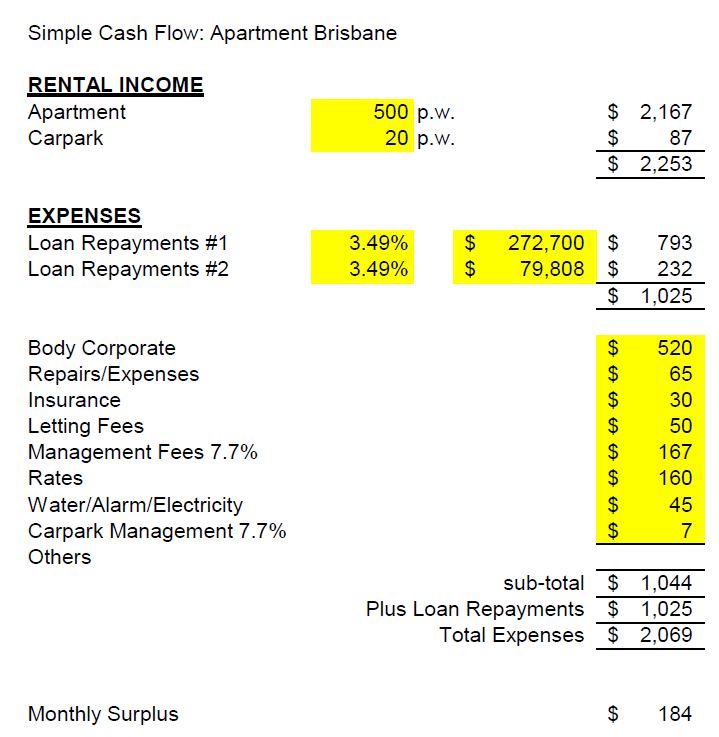

I addressed initially his immediate concern- the CASH FLOW.

After going through his statements for the previous 12 months, I put together an excel spreadsheet for him.

He had never done this. And also didn’t know the exact interest rate he was paying, even how much monthly his repayments were or how much his Body Corporate expenses were.

(If you are a details type person, you may find this strange, but I can say from my 35 years in the business, there are MANY property investors just like this)

All he “knew” was the Body Corporate was “overcharging” , the bank repayments were “way too high”, and all the expensive repairs and upkeep on the apartment was “killing him.”

Now, as you can see from the spreadsheet I prepared below, the repairs and upkeep that was “killing him” was $65 a week for the previous 12 months. Not too bad for a 17-year-old apartment.

The body corporate fees were standard charges for a building of the size he owned.

And all the other costs were normal.

The flat was generating $500 per week in rental income, even in the middle of Covid 19- and he had never had any prolonged vacancy over the whole period he owned it.

He was also getting an extra $20 a week for his car park, as the tenants didn’t own a car so he could rent that separately.

Here is the EXACT spreadsheet I gave him:

So the apartment investment that was “killing him financially” ACTUALLY was cash flow positive to the tune of A$184 per month!

So it was hardly “bleeding him dry.”

But I was surprised to see there were TWO mortgages on the property.

The first one was $272,700 which represented the original 90% loan he took out when he purchased.

The repayment should have been $793 per month not the $1,025 he was paying.

Which also meant his positive cash flow SHOULD have been $184 plus $232 per month, a total $416.

(Obviously, he had never made ANY capital repayments in that time, and was still paying the original “interest-only” loan: as they are known in Australia.)

BUT he seemed to have ANOTHER mortgage on the property, ALSO interest only at same interest rate, for $79,808.

When I asked him about that he said “Oh, THAT – yes, when the value of the flat went up, I was able to refinance and get another $80K out against the new value!”

I asked what he did with that $80K, as this is the exact strategy many people use to buy another property. He said he had used it for “other investments”.

So, if he hadn’t re-mortgaged, the real return on the flat would be CASHFLOW positive to the tune of $416 per month!

And even more if he had managed to get the bank to reduce his loan to the current market rate.

RETURN ON INVESTMENT (ROI)

The other thing I analysed for him was the ROI.

He paid $303K, and as of November 2020 at the end of Covid 19 (or perhaps it will be proven to be the middle) it appears the valuation of the property is approximately $435,000.

Obviously, it has come down during Covid.

So here are the actual calculations: (simplified)

Price $303,000

Deposit he paid $ 30,300

Loan 90% $ 272,700

ROI

Assume value is $435,000 (According to bank valuation)

Payback loan ($272,700)

Cash back $162,300

Invested $30,300 received back $162,300* means ROI is equal to 435% return over 17 years from when he took possession.

If we include stamp duty and legal fees on purchase, that will reduce the return a bit, but not significantly.

For a “terrible investment” not too bad!

And we know that the Freehold apartment in Brisbane has not only maintained its value and his capital is safe and secure, but it also has in fact increased – albeit not as strongly as some other property investments, and certainly if he had held his Sydney apartment he would be sitting on a small fortune now.

CASH IN BANK AS AN ALTERNATIVE?

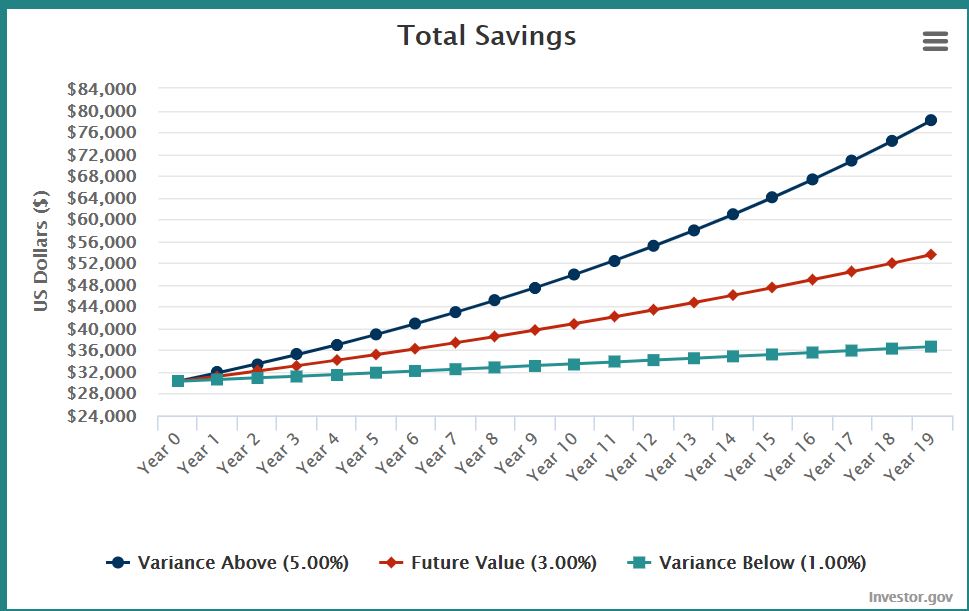

Let’s go back to Bob’s comment that he would “have been much better off leaving the money in the bank.”

The Australian bank savings rates back in 2002-2004 were around 5% and are now down to virtually 0% – so let’s give him the benefit of the doubt- and say that he achieved an average of 3% per annum every year with his $30,300 in the bank.

Below is the chart.

I’ve also allowed for an extra 2% increase as a comparison value to see if he had been able to get 5% average per year what the result would have been.

And the third figure shows the current interest rate, assuming 1%.

And I have taken it for the full 19 years since he first placed his 10% deposit to make an accurate comparison.

So if he HAD left it in the bank, he would now have $53,540, compared to his property equity of $162,300.

Even if he HAD managed to get a fixed 5% return, he would still only have $78,192, less than HALF what his “terrible investment “ had made.

So there you have it.

But here is the kicker.

In a couple of years’ time, it is possible the property will increase in value as the lack of new supply due to Covid will kick in, the population and migration figures will increase, and bank interest rates will stay low.

Which ALSO means he may well be able to lower his mortgage interest rate too!

If the property value jumps up just 20% over the next year or two, his ROI will dramatically explode to over 700%! From the current 435%.

Yes, you read that right!

And THAT my friends, is WHY I believe property to be on of the safest and best investments you can make ….as the use of OPM (Other People’s Money), leverage and compounding makes even an average real estate investment one of the best things you can do with your money.

Of course properties can go up, and down over time…BUT…

The biggest mistake I have usually seen in real estate is SELLING TOO SOON.

*For illustration purposes and simplicity the calculation excludes purchase and selling costs and tax.