This is the true story of “Bob.” An Australian living in Hong Kong.

I met Bob when he arrived in Hong Kong some 20 years ago, and he made two property purchases:

One in Sydney, in Crow’s Nest, a terrific lower north shore suburb. He purchased a 2-bedroom, 2-bathroom spacious (90 sq. m) apartment off -the- plan with a car park.

He also put a 10% deposit on an off-plan apartment in Brisbane.

To hedge his bets.

The Brisbane one completed in 2004 and he took possession for AU$303,000.

(You can see the Brisbane story here)

The Sydney apartment was a large (95 sq. m) apartment in a quiet street on Sydney’s Lower North Shore, in Crows Nest. A fabulous location!

It was a 2 bedroom, 2 bathroom, balcony apartment with a secure lock-up car park, in a low rise brand new under-construction project.

Bob placed his 10% down in 2004 and the property completed in 2005.

Just at the top of the market!

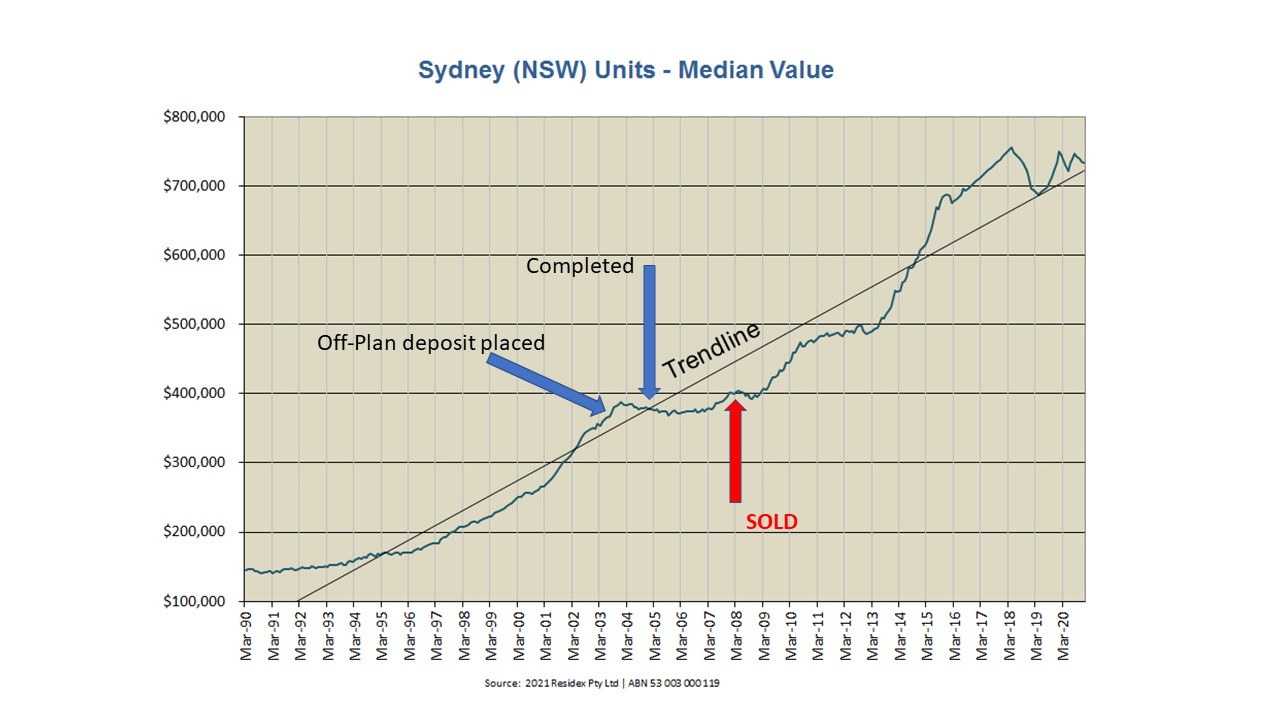

See the graph below.

After a couple of years, the property “hadn’t moved” so he sold it for slightly more than he paid, but nowhere near the windfall gains he was hoping for.

And not enough to cover the stamp duty and costs on the purchase he paid as well as the selling agent’s commission.

He was not happy!

But he was glad he was out of that “terrible investment” as the market still wasn’t moving, and said he would have been better “leaving his money in the bank, would be a far greater return, without legal fees, and stamp duty”.

He paid in round figures $500,000, and secured an 80% mortgage on an interest-only basis.

After selling he recovered his 20% deposit, less a few expenses, and used that money to “invest” into some other (non-Aussie property) investments which sadly have all failed so that capital has now been destroyed.

Here is the point of this story:

-If you own GOOD real estate, don’t sell too soon!

-Even if you buy at the top of the market, you can still do well.

-Real estate is a long-term investment.

Let’s see what happened straight after poor Bob sold!

As can be seen from the graph, Sydney DID enter a long downturn just after Bob committed to buying. Now, no one can blame him for that, and no one knew that was about to happen.

But even with that long downturn, let’s see what would have happed had Bob held on and not sold.

Purchase Price $500,000

Loan 80% $400,000

Deposit 20% $100,000

Costs $ 20,000

Total Cash Outlay $120,000

Value Feb 2021 “ This Unit is estimated to be worth around $990k, with a range from $910k to $1.07m. The Domain property ID is YC-8435-TB”

If sold for say $990,000

Repay loan ($400,000)

Costs on sale ($ 22,000)

Net cashback $568,000

Return is $568K on initial capital of $120k = 373% or 10.20% pa

Not too shabby!

So as mentioned, even with him buying at the TOP of the market, even with a long downturn immediately following his purchases, even with the 2008 global financial crisis, even with the 2020 pandemic, he would still have managed to get over 10% pa annual growth, for the whole 16 years of ownership!

This is a great real estate lesson for every investor.

Don’t sell good real estate too soon! And even if you buy at the top, you can still make great money.

And certainly MUCH more than leaving it in the bank!

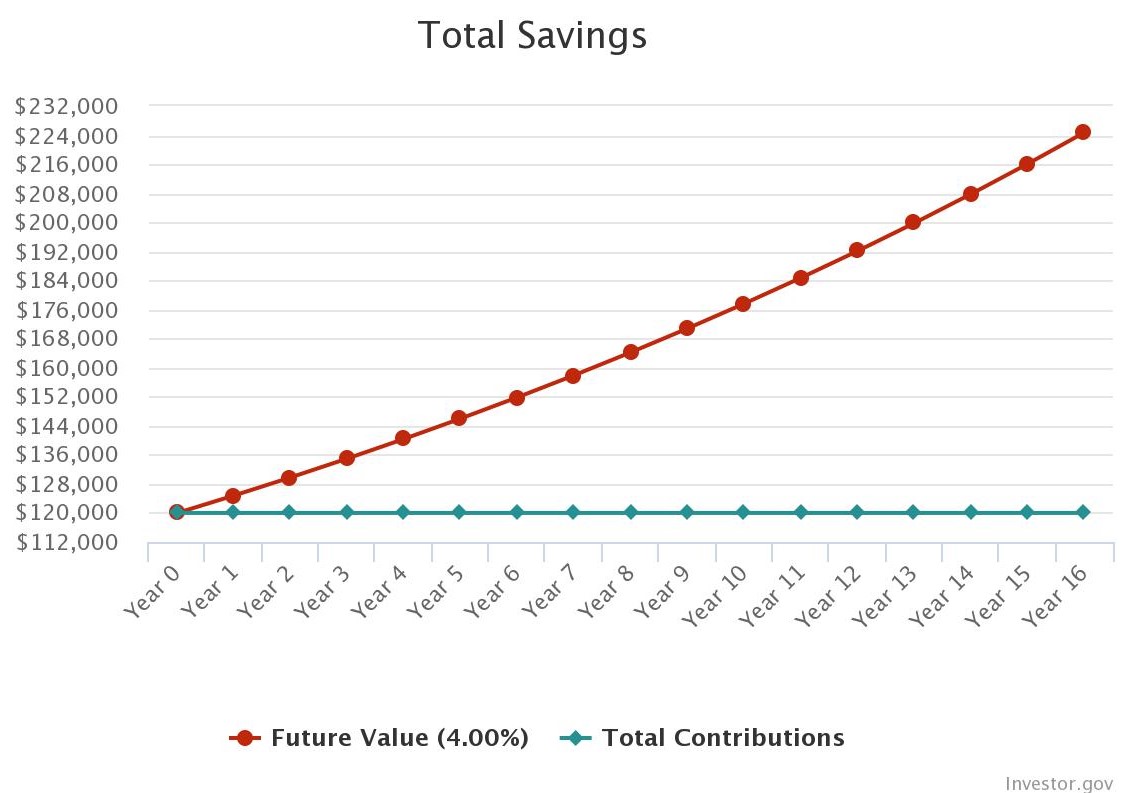

(By the way, if he HAD left it in the bank and managed to get a steady 4% per annum return, his capital would have grown to $224,757, less than half of the $568,000 would have got.

If you have ALREADY purchased and are not happy with your investment, you may want to look into my property advisory service, which may be able to assist,